LOS ANGELES – June 27, 2024 – Levine Leichtman Capital Partners (“LLCP”), a Los Angeles-based private equity firm, today announced that it has acquired NSL Analytical Services, Inc. (“NSL” or the “Company”) in partnership with management. Financial terms of the transaction were not disclosed.

NSL is a leading materials testing provider serving a diverse client base across highly-regulated and technologically-advanced end markets, including aerospace & defense, advanced materials, and electronics, among others. NSL’s experienced chemists, metallurgists and technicians are experts in testing a wide range of materials and finished components, serving the recurring and non-discretionary testing needs of clients throughout the U.S. and across the world. The Company is committed to providing testing speed, accuracy and exceptional customer service, acting as a critical partner in fulfilling customers’ operational and compliance requirements. NSL was founded in 1945 and serves its customers from the Company’s laboratories located in Cleveland, Ohio.

“We are thrilled to partner with NSL, a leader in the materials testing and analysis sector,” said Matthew Frankel, Managing Partner at LLCP. “NSL has established itself as a trusted partner for a loyal client base across numerous high-performance industries. We are excited to work with the NSL team to broaden the Company’s testing capabilities and geographic footprint through both organic initiatives and strategic acquisitions.”

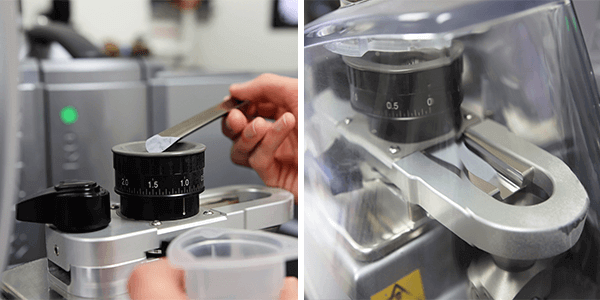

“Our new partnership with LLCP will further guide and fuel NSL’s growth in support of the critical quality assurance testing our team delivers to clients world-wide,” said CEO Ron Wesel. “In an ever-increasing technology-driven world, NSL’s material testing capabilities provide the confidence and security demanded by traditional and evolving production methods such as additive manufacturing.”

NSL is the sixth platform investment of LLCP Lower Middle Market III, L.P. Across its funds, LLCP has invested extensively in the testing, inspection, certification and compliance (“TICC”) industry, including investments in companies such as FlexXray, Technical Safety Services, Trinity Consultants, and Encore Fire Protection, among others.

Honigman LLP acted as legal counsel to LLCP on the transaction.

About Levine Leichtman Capital Partners

Levine Leichtman Capital Partners, LLC is a middle-market private equity firm with a 40-year track record of investing across various targeted sectors, including Business Services, Franchising & Multi-unit, Education & Training and Engineered Products & Manufacturing. LLCP utilizes a differentiated Structured Private Equity investment strategy, combining debt and equity capital investments in portfolio companies. LLCP believes that by investing in a combination of debt and equity securities, it offers management teams growth capital in a highly tailored, flexible investment structure that can be a more attractive alternative than traditional private equity.

LLCP’s global team of dedicated investment professionals is led by 10 partners who have worked at LLCP for an average of 19 years. Since inception, LLCP has managed approximately $14.8 billion of institutional capital across 15 investment funds and has invested in over 100 portfolio companies. LLCP currently manages $10.2 billion of assets and has offices in Los Angeles, New York, Chicago, Miami, London, Stockholm, Amsterdam and Frankfurt.

Contacts

Mark Semer

Gasthalter & Co.

(212) 257 4170

Qualification of materials made by additive manufacturing is